I think it's time to buy gold & silver again. Now I'll give you my reasoning. First off we all know the Fed is going to cut rates. Has anyone else noticed that after every rate cut they start talking about this being the last cut and inflation is a worry yada yada yada? Have you also noticed that right before the next meeting something pops up that necessitates another cut? Now maybe the rest of the world joins the party and starts cutting and the dollar stabilizes against other currencies and maybe it doesn't I don't know. I do know that won't change the fact that every country is running the printing presses. As long as everyone is devaluing their currency then it stands to reason that the price of Gold should go up in every currency. That's exactly whats been happening for the last several years. Now ask yourself what scenario would bring down the price of gold. The Fed tightening and draining liquidity from the system right or a huge gold discovery. Any one want to hazard a guess as to what the odds of either happening are? The other option the central banks have would be to try and control the commodity markets. Basically attempt to keep the liquidity in the paper markets. Well if that is their goal I'd have to say that with gold over $800 and oil at $90 they haven't been too successful.

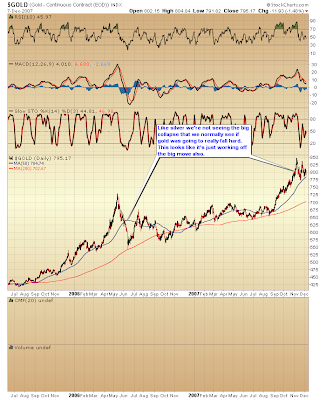

I think it's time to buy gold & silver again. Now I'll give you my reasoning. First off we all know the Fed is going to cut rates. Has anyone else noticed that after every rate cut they start talking about this being the last cut and inflation is a worry yada yada yada? Have you also noticed that right before the next meeting something pops up that necessitates another cut? Now maybe the rest of the world joins the party and starts cutting and the dollar stabilizes against other currencies and maybe it doesn't I don't know. I do know that won't change the fact that every country is running the printing presses. As long as everyone is devaluing their currency then it stands to reason that the price of Gold should go up in every currency. That's exactly whats been happening for the last several years. Now ask yourself what scenario would bring down the price of gold. The Fed tightening and draining liquidity from the system right or a huge gold discovery. Any one want to hazard a guess as to what the odds of either happening are? The other option the central banks have would be to try and control the commodity markets. Basically attempt to keep the liquidity in the paper markets. Well if that is their goal I'd have to say that with gold over $800 and oil at $90 they haven't been too successful.Taking a look at the chart this just doesn't look like a major correction to me. Notice how gold typically just collapses after a powerful run? Silver BTW tends to fall apart even worse because it's an even thinner market. This looks more like a consolidation from the Sept. and Oct. rally to me. This also looks like we may be setting up for another rally of similar proportions. I'm really in no hurry to buy the general market but I will commit my capital to PM as they are in a secular bull market. If I'm wrong in the short term it doesn't matter as the bigger overall trend will eventually correct any short term timing mistakes.